|

Albany Times-Union and The Berkshire Eagle WON'T publish!!! You read it here first! WAMC Northeast Pirate Network®/™ HOME PAGE Listener $$$ lavished on CEO's personal

'perks':

Cars, Chauffeur, Intown apartments! Cuomo book cost WAMC! How Alan Chartock conspired with WAMC to avoid paying IRS. Failure to report CEO's 'fringe benefits' could leave trustees liable. Washington, D.C. Originally published: Thursday, May 11, 2006 Updated: June 25, 2006 For more than two decades, radio station chief executive Alan S. Chartock has been the recipient of expensive fringe benefits provided by his employer, WAMC Northeast Public Radio, benefits that consistently went unreported to IRS apparently in an effort by the public broadcaster to shield its CEO from having to pay income taxes on their value. The result is that money due IRS on these

taxable perquisites - 'perks' - could leave Mr. Chartock owing Uncle

Sam tens of thousands of dollars in back taxes. Add to that 'late'

fees, penalties, interest, plus 'excess

benefit transaction' excise taxes from 10% to 200% of the benefits

received, and the total owed IRS could go well into six-figures.

Further, if IRS determines that WAMC's

CEO engaged in so-called 'self-dealing'

transactions, which, according to the Non-profit

Coordinating Committee of New York, includes "the furnishing

of services to a board member without charge or at a price below their

market value," it could result in IRS leveling upon the public

radio executive a five percent excise tax on each act of self-dealing.

Additionally, if any of the above activities

is deemed by the agency to be willful tax evasion, the former SUNY

professor could be subject to criminal prosecution since there is no statute

of limitations on the filing of false or fraudulent returns, or on a willful

attempt to evade tax.

As if that were not enough, not only could

WAMC's long-time boss be on the hook to IRS, but if it were determined

by the agency that members of WAMC's board of trustees were complicit over

the years in the failure to report the fair market value of perks given

the radio executive, such finding could leave the station's executive

committee trustees liable, like the CEO, for excess benefit excise

taxes on the value of the unreported perks, and, of greater import, could

expose the public broadcaster to loss of its cherished tax-exempt status.

Mr. Chartock's taxable benefits over the past twenty-plus years include free use of: WAMC-owned vehicles to commute to and from work and for personal travel; apartments in WAMC-owned buildings; WAMC-owned assets for personal purposes; and organization employees on company time to perform personal services and to engage in work intended for the CEO's personal gain. All of the above transacted during Mr. Chartock's tenure as WAMC's board chairman and executive director, and as president and CEO. During this time, Mr. Chartock was acting with the blessing of WAMC's board of trustees, in particular its executive committee. Also, the organization's finances were being audited regularly by the accounting firm, Urbach, Kahn & Werlin, Advisors, Inc., the public broadcaster's long-time CPA.

IRS has publications explaining exactly

how fringe benefits are defined, and how, under the tax code, they are

to be treated. The Employer's

Tax Guide to Fringe Benefits defines fringe benefit as: "...

a form of pay for the performance of services" and gives the following

example: "... you provide an employee with a fringe benefit when you

allow the employee to use a business vehicle to commute to and from work."

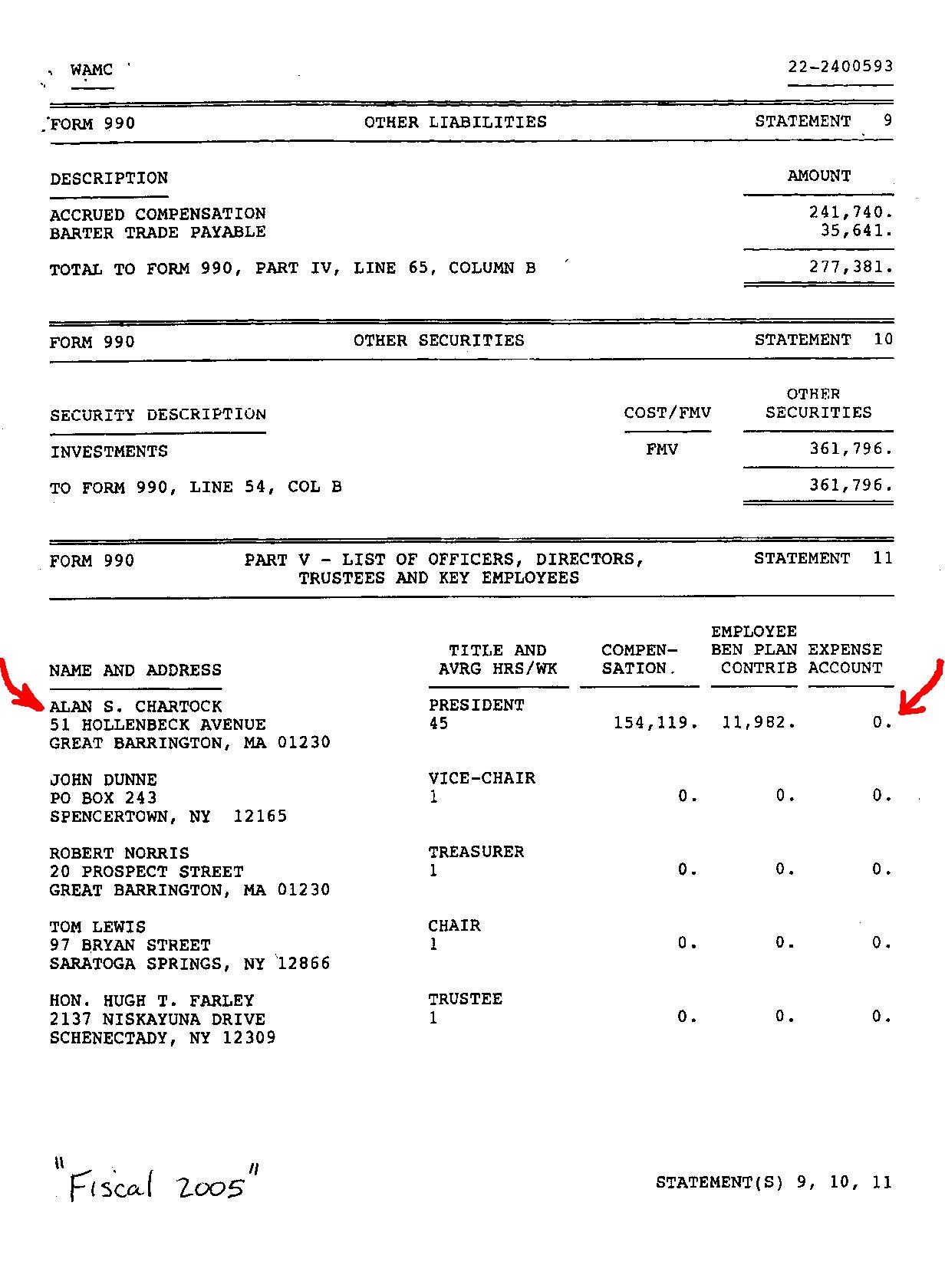

Another agency publication, the Taxable Fringe Benefit Guide, states: "Fringe benefits for employees are taxable wages unless specifically excluded by a section of the Internal Revenue Code," and "Taxable fringe benefits are valued at the Fair Market Value." This means, for example, that the vehicles WAMC has provided yearly to Mr. Chartock to commute to and from work are a form of pay that IRS considers taxable income. Even a cursory look at WAMC's IRS Form

990, the annual return filed by organizations exempt from income tax, shows

WAMC's failure to report accurately its executive employee fringe benefits.

For example, in the past eight years, WAMC

consistently reported 'None'

or zero dollars next to CEO Chartock's name in the space provided where

expense accounts, allowances, taxable and non-taxable fringe benefits are

to be tallied and reported.

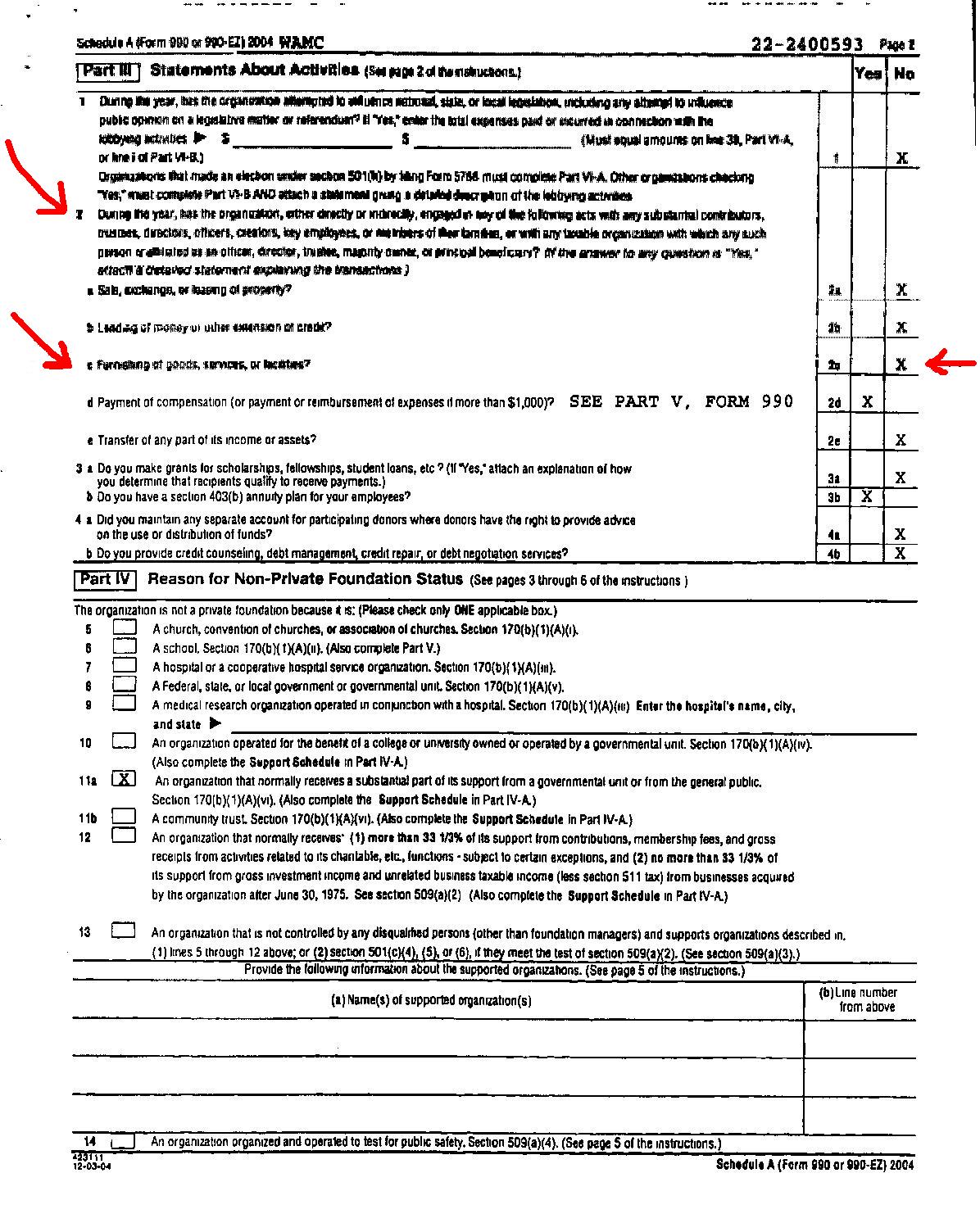

Similarly during those years, WAMC consistently

answered 'NO'

to the question of whether any trustee, officer or other insider was furnished

with "goods,

services, or facilities" (such as would indicate self-dealing,

below-market transactions, or being given special consideration) by the

organization.

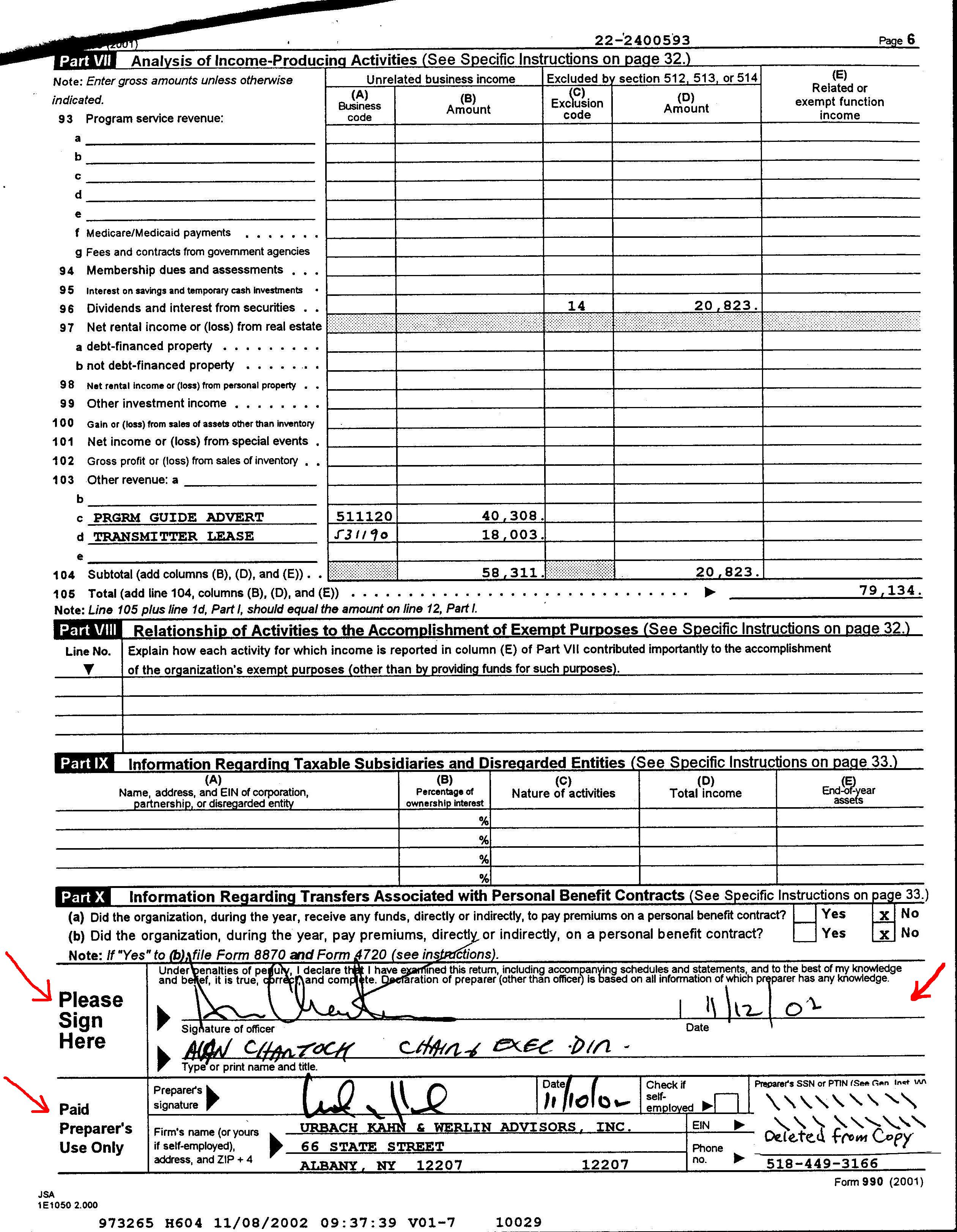

What all this means is that WAMC regularly declared to IRS that, other than actual salary, Mr. Chartock received no other forms of taxable compensation (e.g.: no fringe benefits) from the organization. Yet, this appears to be blatantly false, based not only upon eyewitness accounts of current and former WAMC employees, but also upon data contained in the organization's own detailed lists of depreciated assets (part of its Form 990). What's more, the charity's returns going back to the 1980's show similar evidence that the CEO's taxable perks were never reported, or at best, drastically under-reported. Since 1981, the signature page of all of

WAMC's annual Form 990 returns have been signed by Mr. Chartock as WAMC's

CEO. His signed oath states:"Under penalties of perjury,

I declare that I have examined this return, including accompanying schedules

and statements, and to the best of my knowledge and belief, it is true,

correct, and complete."

WAMC, Inc. is registered with IRS as a 501c3, not-for-profit, charitable, educational broadcaster. In WAMC's latest filing with IRS, Fiscal 2005, the station claimed revenues totaling more than $6 million. About a third of this amount comes from listeners making contributions during on-air fund drives; the rest is from corporate underwriters and grants from private foundations and government. If IRS were to take away WAMC's exempt status, it would mean contributions to the broadcaster would no longer qualify as tax deductible. Not-For-Whose-Profit?

Free Cars, Free Chauffeur (Just

why does a public radio exec need a chauffeur!?!)

The benefit annually to Mr. Chartock in

being able to use all-expenses-paid company vehicles, rather than having

to buy and maintain his own, is obvious to the average vehicle owner.

Cash savings are substantial and immediate (especially during times of

expensive fuel).

Many WAMC staffers, especially those owning their own vehicles, have been keenly aware of the boss's sweet deal with the charity. One former employee, who asks to remain anonymous, remembers a then-brand-new 1995 Chevrolet Lumina sedan owned by WAMC, but used exclusively by Mr. Chartock, "Last I remember, Alan had a blue or green Chevy Lumina. The Geo Metro and the van (other company-owned vehicles in the station's small fleet) are the employee cars. I don't recall anyone ever using the Lumina except Alan," says the former staffer. "I don't recall Alan ever driving any car but the Lumina which I'm sure is a station car. It was always described to us as one of his perks." At some point, Mr. Chartock determined that a driver was necessary to chauffeur him to appointments and destinations, even to places having nothing to do with organization business. WAMC employees were enlisted for this purpose, even hired specifically for the task. That is how one rough-and-ready 28-year-old Marine Corps veteran came to work for WAMC. Joshua Cohen had served a tour of duty with Uncle Sam that ended in 1990. He had gone on to graduate from SUNY-New Paltz in 1993 with a Bachelor's in Political Science. Back then, Mr. Cohen (Josh to his friends) was looking to start a career in Albany. He answered an advertisement in the Times-Union in late January 1994 for an entry-level 'gofer' position at WAMC. "One of the requirements of the job was that I'd have to drive Alan to New Paltz once a week," Cohen says he was told during the interview process at the station, "And I was asked if I was okay with that, with driving him there. I told them there'd be no problem with that." Mr. Cohen says that when he phoned WAMC the day after the interview, he was told he got the job. The position worked out well enough that Cohen served as Chartock's regular driver from February, 1994 through August, 1995, a period of nineteen months. He was thus able to observe the radio executive at close range in his daily travels, routines and habits, as well as for hours at a time within the confines of an automobile. When Cohen drove, Chartock would usually sit up front. The times he went in back were to nap. This propensity to sit up front made it relatively easy for Mr. Cohen to overhear Mr. Chartock's side of multitudes of cellular telephone conversations. One of his regular chauffeured stops for Chartock, according to Cohen, was SUNY's UAlbany campus. As a full-time professor of political science and communications, Chartock would teach classes there and meet with students. Cohen says he would deliver Chartock to campus, a distance less than four miles from WAMC, then drive back to the station to pursue his day's other tasks. Later, he would return to pick-up the WAMC boss for the drive back to the studio. Mr. Chartock got in the habit of commuting in this fashion around and about Albany. Another regular destination was a local television station where Mr. Chartock appeared nightly on the evening newscast to give commentary composed of personal insights into the realm of politics. At times, Mr. Cohen was told to wait. Thus, while Mr. Chartock was inside being paid by the TV station, his driver outside was being paid by WAMC. Another favored stop was The Legislative Gazette, a student-run weekly newspaper, then located in the Alfred E. Smith Building about 1.3 miles from WAMC. (Mr. Chartock is still listed as executive publisher and project director.) Chauffeured destinations were not limited to Albany's metro area. There were, of course, the weekly trips to SUNY's New Paltz campus, about 75 miles south of Albany. "Every Friday that there was a class, I'd drive him," says Mr. Cohen, "It'd be an hour and a half each way. We'd go every Friday during semesters." Chartock's instructions were for Cohen to wait while the professor spent all day either in classes or meeting with students at his on-campus office. Mr. Cohen was not complaining; he was on WAMC's clock while the professor during these periods was on SUNY time. "We'd be gone from 8:30 til 4:30. I'd hang out with my friends," says Cohen, who, since he had recently graduated from New Paltz, still knew people at the school. At the end of the day, Cohen would pick up his boss and they would make the long drive back to the station. One of the various tasks that fell to Mr. Cohen at WAMC was making sure the organization's small fleet of vehicles -- a Chevy Lumina mini-van, a red Geo Metro, and the blue Lumina used by Chartock -- were kept maintained, cleaned, and fueled. "Except with Alan's car, he always kept after me to keep it really clean and washed all the time. It was more than I thought really was appropriate," says Cohen. "..... there were more important things that the station needed done than taking care of his personal car." Mr. Cohen never saw Mr. Chartock drive anything but his WAMC-owned vehicle. Asked what kind of car did Mr. Chartock actually own, he replies, "I never even saw one. To my knowledge, he did not have a private car of his own. His wife had a car, but when I would sometimes have to drive him to Great Barrington, and stopped at his house, there was never any car in the driveway. His wife works. I never saw him drive any vehicle besides those owned by WAMC." The distance from Mr. Chartock's Great Barrington residence to WAMC's studio runs about 51 miles each way. This means Mr. Chartock, in addition to his various travels around Albany and beyond, was putting 500 to 600 miles weekly on the company car just in commuting to and from work -- and this did not include side trips to go sushi bar-hopping or food shopping along Route 7 near his home. As a corporate perk, a vehicle is obviously one of the more desirable, and according to Mr. Cohen, WAMC paid for everything. "To my knowledge, he used the WAMC station-owned vehicle as if it were his own. I had the station's credit card, and I was told to put the gas in at the Mobil down the street," he says. Indeed, WAMC spared nothing. Mr. Chartock not only got use of new or late model vehicles over the years, but the cost of everything ancillary was paid for by the radio station -- applicable new car sales taxes, titling fees, insurance premiums, annual inspections, maintenance and gasoline. While it is not unusual for a US corporation

to allow its executives use of company-owned vehicles for business-related

travel,

IRS regulations make very clear that the company is responsible

for reporting as a fringe benefit the value when the vehicle, as in Mr.

Chartock's circumstance, is used primarily for commuting to and from work,

or for purposes unrelated to the firm's business.

There were other chauffeured destinations, according to Mr. Cohen who is married now with two young children, is employed as a technical analyst in the defense industry, and lives within range of WAMC's Plattsburg station, WCEL-FM. Chartock would be invited to speak before

various assembled groups. Cohen says Chartock would usually be compensated

for his public speaking efforts. He would have Cohen chauffeur him

to these private gatherings. "I once drove him to a speech that he gave

in the 'Borscht' belt. We got there and I waited all day for Alan

to finish," recalls Cohen.

Asked whether Chartock's chauffeured trips had anything to do with WAMC business, Mr. Cohen replies, "Most of the time I'd drive him to events, (which) most of the time had nothing to do with his radio station job, but had some other purpose." On a few occasions, Cohen would be instructed to drive to Chartock's Great Barrington residence. One time, Cohen recalls, Chartock had him transport a computer technician who brought along a new personal computer to install in Chartock's home. Chartock wanted the PC connected to a special Intra-net line that Cohen believes his boss had the phone company install to connect his house to WAMC's computer network. While Chartock waited back at the station, the trusted Cohen kept watch in Chartock's home while the techie connected the computer to the new Intra-net link. Afterwards, Cohen returned the techie back to Albany. Cohen says the station provided the PC and the expensive Intra-net line so Chartock could access office e-mail from home. According to Cohen, Chartock had use of at least two cellular phones provided by the radio station. This was during a time when cellular was relatively new to the Albany area and having even one cell phone was considered something of a status symbol since the expense of the service was considerably more than it is today. "He had a nice one at the time, he even showed it to his class in New Paltz once," Cohen says, adding, "He also had a car phone in the WAMC vehicle he used. There was no car cell phone installed in any other WAMC-owned vehicle. When in the vehicle, he used the car phone." According to WAMC's depreciation report, the charity paid $489 to equip Mr. Chartock's vehicle with its car phone. Today, WAMC's chief executive is driving the station's latest vehicle purchase, a 2006 Subaru Forester 2.5X, 'The L.L. Bean Edition' (MSRP $27,520), a car specifically picked out by and for Mr. Chartock. This replaces a 2004 Forester still carried on the station's books. At two years, it was apparently too old to be of any more use to a public broadcasting executive. At night, the new Forester, a gleaming

metallic gray, can be seen parked in the Chartock driveway on Hollenbeck

Avenue.

When asked recently about Chartock's local use of the vehicle, a high-profile Great Barrington town employee, who asked not to be identified but prides himself on being more aware than most of the comings and goings of folks around this wealthy southern Berkshire enclave of seventy-five hundred, laughed and said, "Oh yeah, I see him driving it around all the time!" Free In-Town Pied-a-terre

A few doors down from the studio on the same side of the street (going in the opposite direction from the WAMC Center for the Performing Arts) is a very special WAMC-owned property. Once home to a lending institution, it now houses Mr. Chartock's intown pied-a-terre -- a rent-free home away from home. Another former staffer recalls, "The apartment is located on the second floor at the old Evergreen bank building ... . I only saw it when it was a crumbling mess." This staffer, who also requests anonymity, is referring to the space upstairs at 300 & 304 Central Avenue that WAMC provides to Mr. Chartock for his personal use. After WAMC obtained the land and set of buildings in September, 1996 from Evergreen Bank, WAMC invested at least $160,000 in renovations to the parcel, according to the station's depreciation reports. The second floor was converted to a spacious, multi-bedroom apartment suite. About that converted space, the anonymous staffer says, "I believe it has two bedrooms - it takes up the entire 2nd floor. It's not a luxury pad, but I'm sure it's nice." Luxury or not, WAMC spared no expense in fixing up that second floor space by shelling out, according to its depreciation reports, at least another $25,000 in renovations (on top of the $160,000). "Alan always said it would be available for people who were stuck at the station because of weather, but I've never known anyone to ever stay there besides Alan," says the anonymous staffer, who, in an e-mail, adds, "I don't know who furnished it but I can't imagine Alan did - I'm sure everything - furnishing, utilities, etc. is all covered by the station and this $$$ is not reflected in Alan's official compensation." The staffer may not know, but WAMC's depreciation reports list numerous entries for furniture purchases. Mr. Chartock has nearly always had some

form of WAMC-provided after-hours accommodations though perhaps not as

expansive as his present quarters. Josh Cohen remembers when he was

there that Chartock

"had a furnished room on the second floor of WAMC,"

above the main office at 318 Central Avenue. The radio station provided

the space, he says, paying for all utilities and outfitting it with all

sorts of amenities, even adding a shower for the boss's convenience.

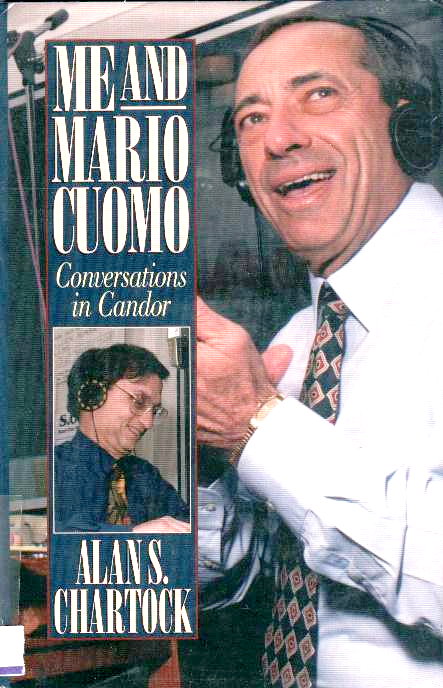

Free Labor to Produce 'Me and Mario

Cuomo'

In it, the author proffers dialogue extracted from The Capital Connection, a WAMC radio program whereon Mr. Chartock weekly lobbed ingratiating questions to the then-serving Governor. To get the book published necessitated converting spoken words on audio tape into manuscript form. This meant that a few hundred hours of CapCon recordings (the rights to which are owned by WAMC's in-house subsidiary, National Productions) had to be played-back and transcribed by typists using wordprocessors. The whole thing then had to be printed-out, edited and compiled. It was a lot of drudge work. To these ends, Mr. Chartock enlisted as many as four others. They were employed by, or connected with WAMC, including at least one senior management employee and one trustee who, at the time, sat on the executive committee. WAMC office space and equipment were commandeered for the project. The employees doing the work were on company time. Josh Cohen recalls vividly in an e-mail, "Yes, I was there when the idea came up and when the book was put together." Cohen says the project took "several weeks, more then (sic) one month, but I don't think it went past two." Mr. Cohen adds, "... Selma Kaplan essentially put the whole thing together, Alan editied (sic) it, basically by reading it in Selma's presence and telling her what to change." Cohen says he saw "... Selma use her WAMC office, computer, telephone," during her time on the project, and, he adds, "everything she needed in her office was used." Kaplan's title today at WAMC is vice president for administration and development. About the trustee, Mr. Cohen says, "One of the board members was also involved ..... I think the name was 'Metronni' (sic) or something like that," referring to Aaron Mitrani who in 1995 was WAMC's corporate treasurer. Cohen adds, "... this is the one who helped in some way to get the book published .... ." Mr. Mitrani, a long-time trustee and friend of Mr. Chartock, died in March, 2005. Mr. Cohen names two other WAMC staffers whom he believes worked on the project and had "some role but this is not certain, they usually helped Selma with all she did regardless of what it was." He adds, "I think they (referring to Chartock and WAMC) hired out a company to do some of the work, at least I recall hearing this mentioned." Asked who paid for the outside company, Cohen says, "WAMC certainly would have been the payer," but Cohen acknowledges he is not entirely sure the outside firm was ever hired. Alan Chartock's name and image appear on

the book's cover as author. Barricade Books is named

as publisher. In the book's "Acknowledgments" section, Mr.

Chartock thanks "all the teaching assistants at SUNY who helped transcribe

so many years' worth of broadcasts," as well as Ms. Kaplan who he says,

"deserves

an awful lot of credit for reading, editing and typing the manuscript in

several versions." Never acknowledged was WAMC, which owns the

rights to The Capital Connection program, nor WAMC's contributing

listeners all of whom actually foot the bill for this private publishing

effort.

Getting away with it

The obvious answer to both questions is that WAMC's board of trustees - plainly as docile a group as ever there was running a public broadcaster - has apparently been more than willing to let Mr. Chartock have his way at the station, so much so that he has been allowed near absolute control of the public broadcaster. The trustees, particularly the board's executive committee, appear simply to look the other way, and let Mr. Chartock shield his taxable benefits from disclosure to IRS. Telephone inquiries made to WAMC executive committee members, including Mr. Chartock as well as board chairman Thomas S.W. Lewis, professor of English at Skidmore College (where Mr. Lewis holds the title of Quadracci Professor of Social Responsibility), seeking comment as to why the organization failed over the years to account properly for Mr. Chartock's taxable benefits have thus far proven fruitless. Repeated messages were left, but no calls ever were returned. When asked about the relationship between Mr. Chartock and his board of trustees, Josh Cohen, who during his employ at the station says he personally attended and observed no less than fifteen of the monthly trustee meetings, says, "I never got the feeling he [referring to Chartock] was concerned about any regulatory or oversight body at WAMC -- he really acted like no one could touch him." Asked in an e-mail why he had attended so many board meetings, Cohen replied, "I was present at nearly every single one during the time I worked there as it was my job to go out and get food for them in the form of fruit, chinese food. I had to set up a room for the board meetings and then break it down after. It was part of my job to support the meetings in that manner as well as stay at the station when until they ended and everyone left." About Chartock's board, Cohen recalls,

"The

board and trustees seemed like something Alan had to do to keep the non-profit

status, though it was not a group that held any influence at all, at least

as I could tell." Cohen adds, "He really never talked

about them, nearly as if they did not exist or did not matter, at least

that was my impression."

When contacted by telephone at his office, Mr. Kahn acknowledged, "We are the accountants for WAMC; we conduct audits; we also prepare the tax returns." He further confirmed that his tax preparer number was indeed the one appearing on WAMC's Form 990's filed over the years with IRS. He would not confirm though, that the signature on the form was actually his. He was asked about WAMC's accounting for employee fringe benefits, but refused to answer that or any further questions about WAMC, claiming, "Our professional standards as CPA's preclude us from discussing any matters regarding clients with the press." When asked what his firm recommends in general to tax-exempt clients regarding accounting for taxable and non-taxable fringe benefits, Mr. Kahn refused to answer and hung-up on his caller. For more than twenty years, WAMC has used UKW to audit its books and to prepare the organization's IRS filings. The firm has expanded from its local roots, and its Web site says the name is now UHY LLP Certified Public Accountants. It claims a full range of public accounting services as well as tax and business consulting, with offices in multiple states and the District of Columbia. WAMC has steadfastly maintained its relationship

with UKW/UHY LLP despite the fact that other public broadcasters

are heeding the intent of the Sarbanes-Oxley

Act of 2002. That Act, passed by Congress in the

wake of corporate accounting scandals at public corporations like Enron,

Worldcom and Global Crossing, requires auditors to

be 'rotated' every five years.

The way the law is now written, publicly-owned corporations come under the jurisdiction of Sarbenes-Oxley, but tax-exempts like WAMC do not. Nonetheless, many public broadcasters, concerned about maintaining listener and viewer trust and support, are following the lead of Sarbanes-Oxley in order to prevent the kind of breakdown and conflicts-of-interest that occurred, for example, between former 'Big 5' accounting firm, Arthur Andersen and officials at its corporate client, Enron. Andersen was indicted for falsifying Enron's financial statements. Coincidentally, another long-time UKW/UHY LLP client, and a tax-exempt entity like WAMC, was the Saratoga Performing Arts Center. SPAC was the subject of intense public scrutiny in 2004 when its patron, the New York State Office of Parks, Recreation and Historic Preservation, ordered the organization to have an outside auditor examine its finances. The report that ultimately issued exposed executive mismanagement, ineptitude at the board level, and a pattern of corruption within the arts organization. The outside audit highlighted bloated executive salaries, inadequate financial controls, executive self-dealing, no-limit expense and travel accounts, and financial relationships between SPAC's former president Herbert Chesbrough and board members who did business with SPAC. The report noted, for example, that Chesbrough approved his own expenses and signed his own checks. The revelations ultimately led to a shake-up of SPAC's board of trustees and cancellation of a 'sweetheart' separation agreement the board had made with Chesbrough to buy-out his employment contract. In addition to the fact that the two not-for-profits, WAMC and SPAC, shared the same auditor (though UKW/UHY LLP is no longer SPAC's accountant), there is another practice the two shared in common, and which may indicate self-dealing and inadequate financial controls within WAMC's executive suite. It is the practice of allowing the CEO dual authority both to approve expenses as well as to sign company checks. When asked whose signatures appeared on

his bi-weekly WAMC paychecks, Josh Cohen replied, "That's an easy

one, Alan Chartock," and he adds, "I don't recall a co-signer." «««

Another option for employers is to use the guide's Annual Lease Value Table to compute the annual benefit using the vehicle's Fair Market Value. Fair Market Value of an automobile is defined as: "... the amount a person would pay to buy it from a third party in an arm's-length transaction in the area in which the automobile is bought or leased. That amount includes all purchase expenses, such as sales tax and title fees." For a vehicle valued over

$14,800 (as is the case with the WAMC-owned Subaru that Mr. Chartock now

drives which has an MSRP of $27,520), using the Lease Value Table might

lower the employee's overall tax bite, except that by using the Table,

fuel costs, if paid by or reimbursed through the employer, must be accounted

for as a separate and additional taxable benefit.

A search in Google

using the terms

'albany

limousine service' generates leads to a number of competitively-priced

carriers in the capital region. The one nearest WAMC is possibly

Advantage

Limousine located on Lark Street just nine-tenths of a mile from the

studio. A caller to Advantage elicited the following rate

schedule for the firm's least expensive chauffeured services: Trips within

the Albany metro area lasting less than two hours duration come under the

carrier's

'basic transfer rate' of $110.08. That all-inclusive total

pays for a driver, a 2005 four-door Lincoln Continental or Cadillac

Sedan Deville, driver's gratuity, and all fees. For trips outside

metro, driver with sedan costs $60 per hour, plus 15% gratuity and 8% fuel

charge. Corporate accounts are eligible for a 20% discount.

Write to the following address (include whatever information you believe would be useful to IRS examiners): IRS - E.O. ClassificationIRS 'Bounty' Program:

James Foley Bldg.WAMC-FM's Federal Tax ID information: WAMC, Inc.Notice to All CPA's and Tax Professionals! For the sake of accuracy (and fairness), The WAMC Pirates invite feedback on the above article from certified public accountants and others with knowledge of federal and/or state tax laws and regulations. If there is any documentation, information or other material we neglected to include as part of this article, but should have (e.g.: additional likely tax law violations, legal interpretations, etc.), we would like to know about it. Likewise, if there is any information, legal interpretation, documentation, citation, material or data contained within the above article that is inaccurate, misleading, or inapplicable in any way, we also would like to be told about it. Please feel free to bring suggested additions or deficiencies to our immediate attention so that the article can be properly amended. Contact The Pirates via e-mail at editor@wamc.net, or via telephone at 202.973.2141. Thank you! Logon to WAMC

Pirates' Blog - Post your own comments about WAMC-FM

OPENING PAGE |

|

WAMC

foot the bill for creating the book 'Me and Mario Cuomo'

WAMC

foot the bill for creating the book 'Me and Mario Cuomo'