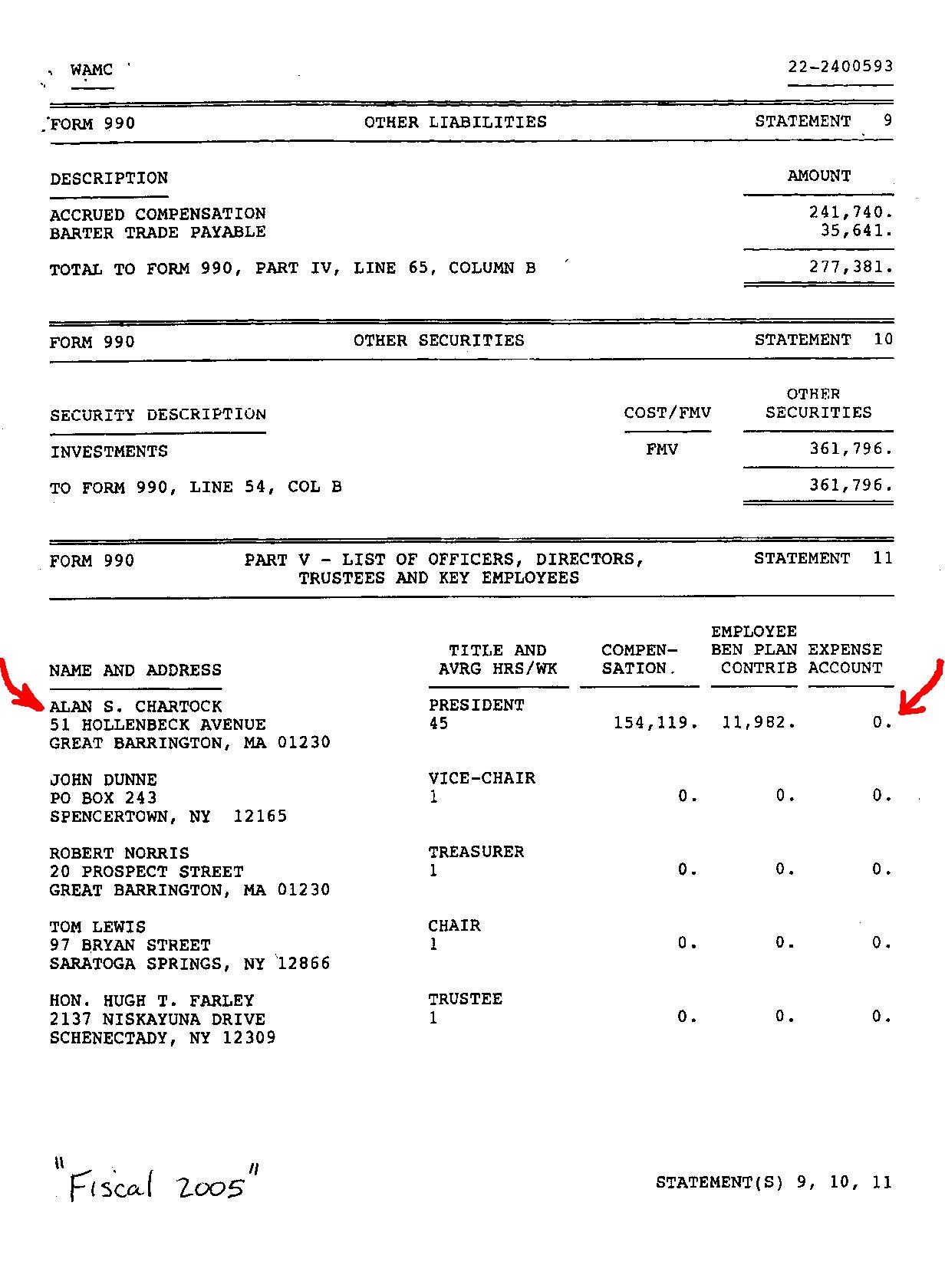

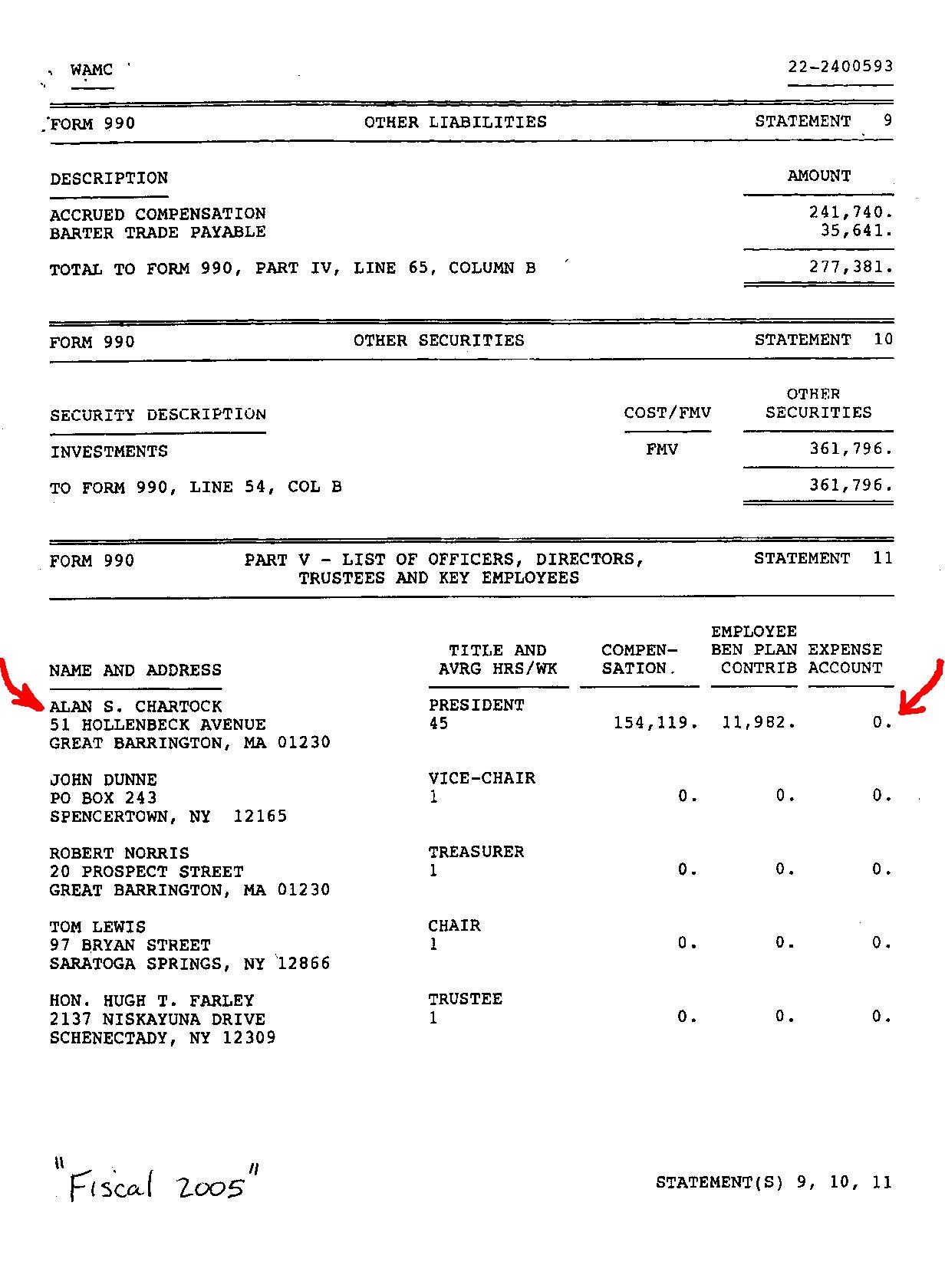

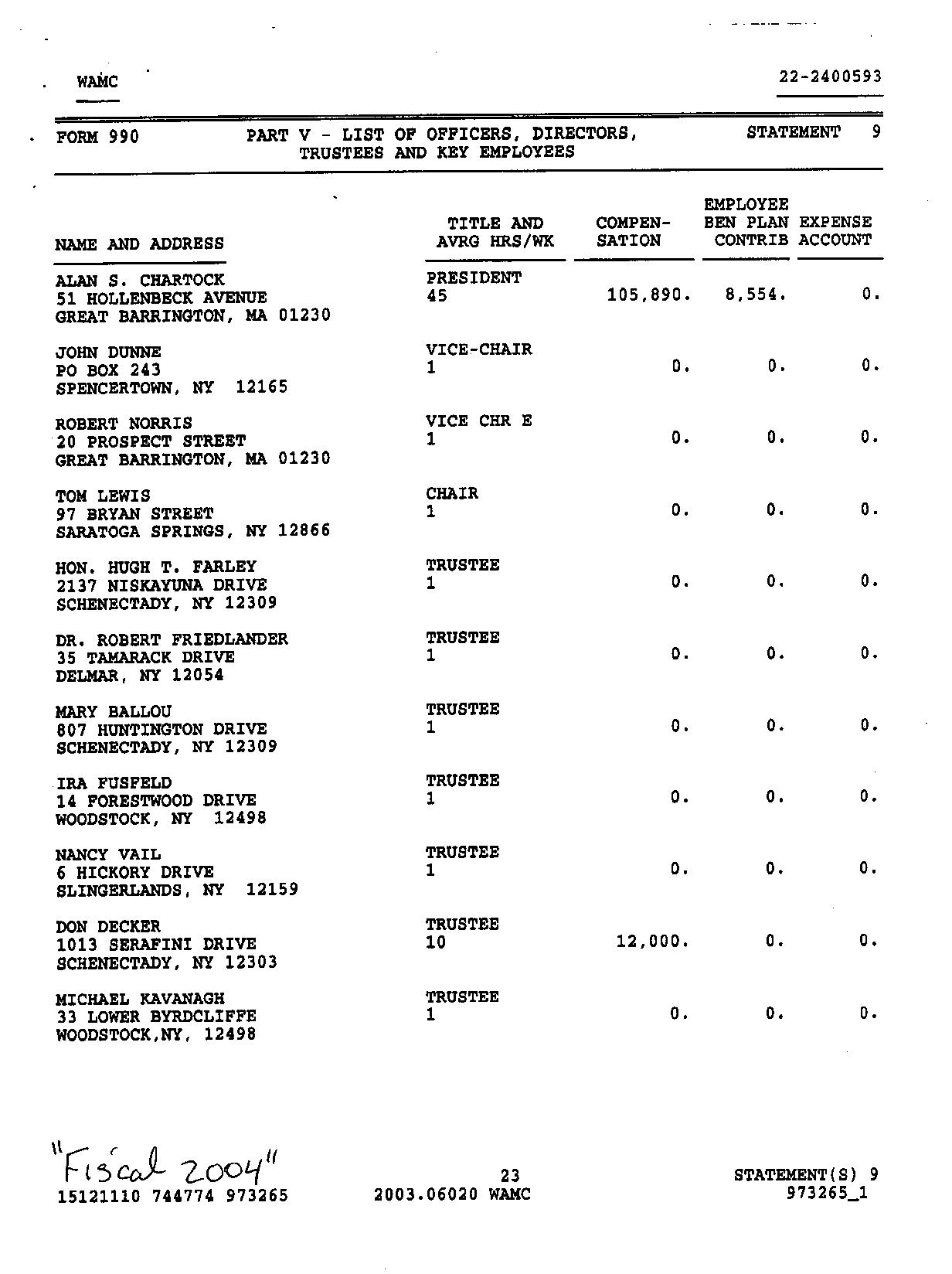

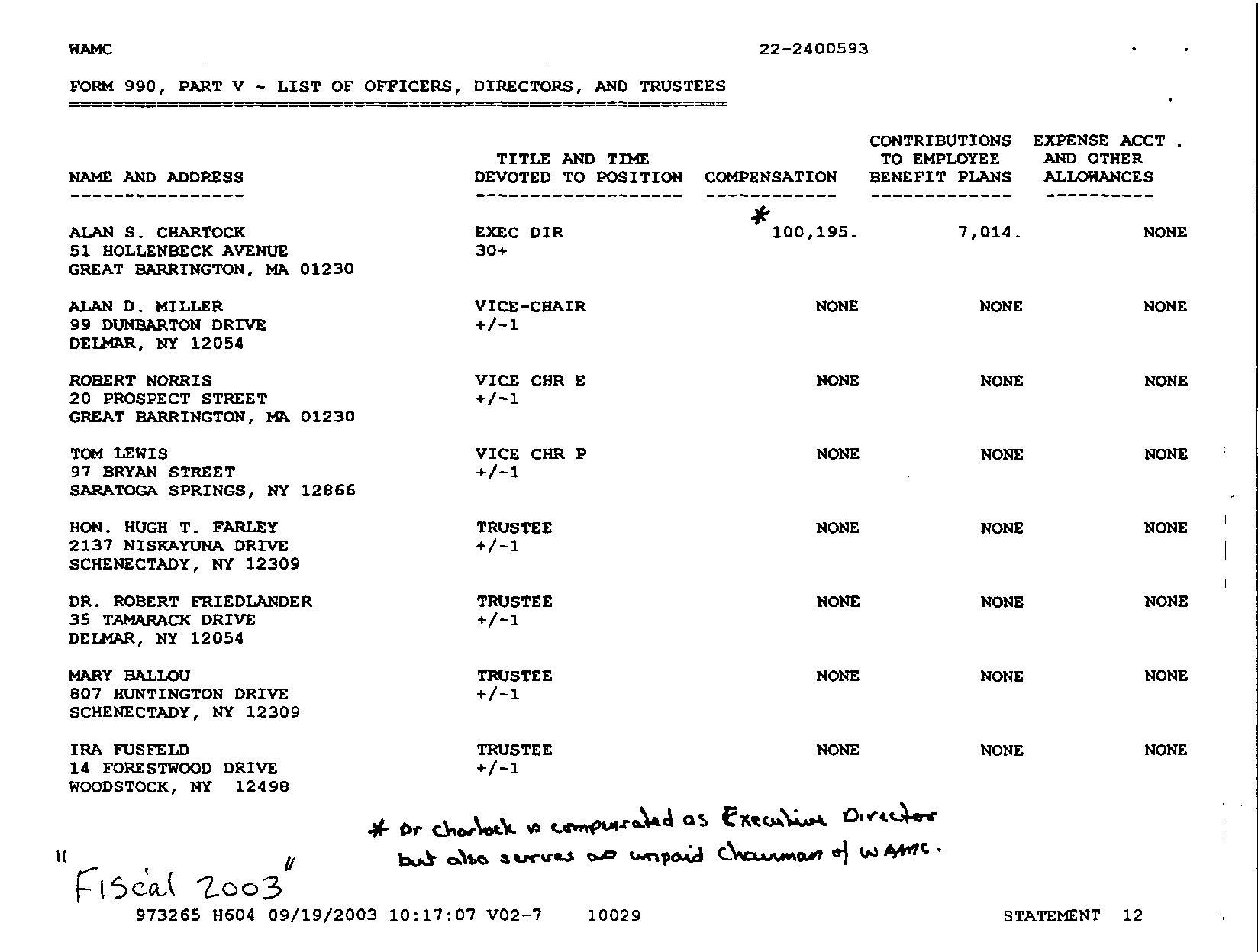

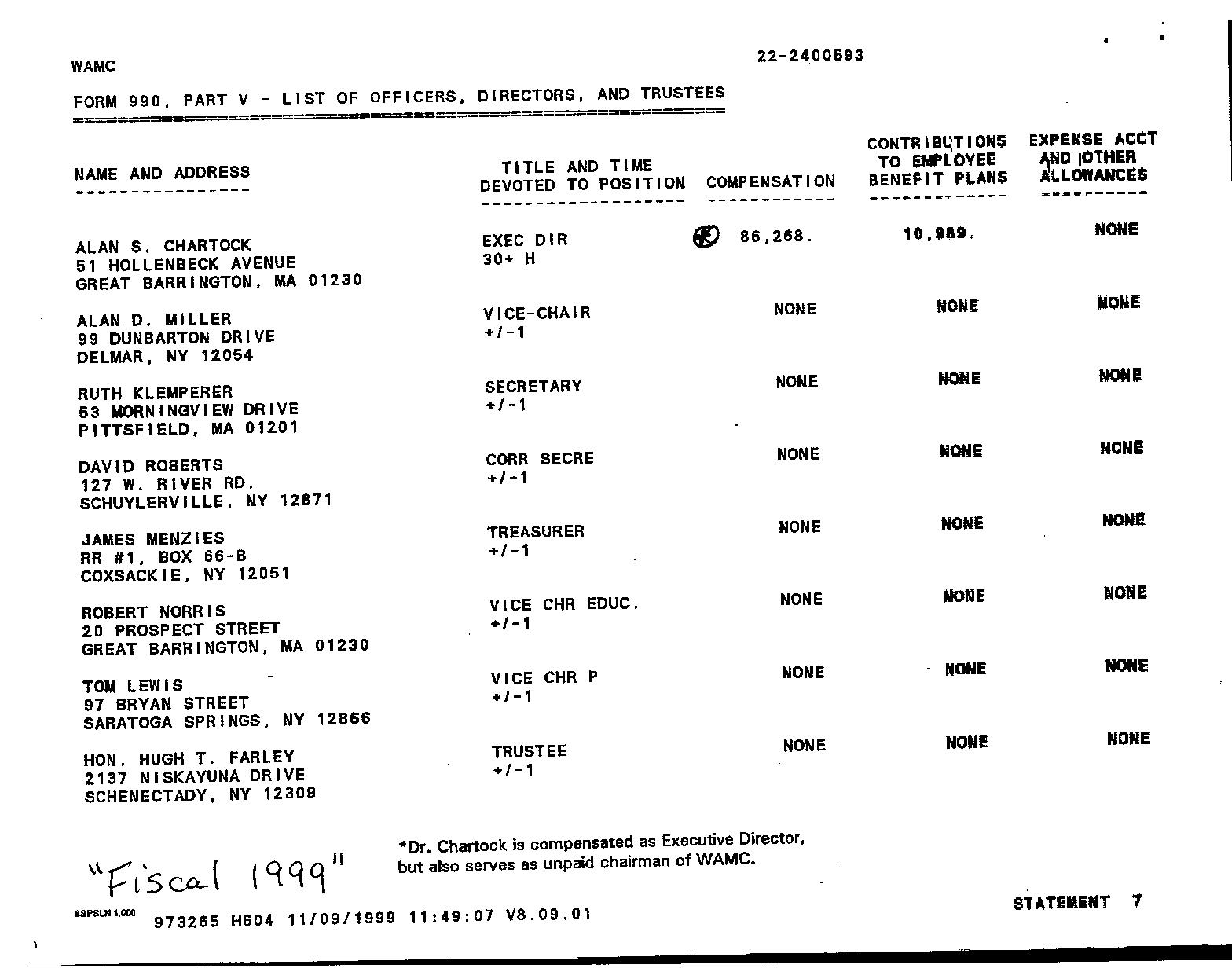

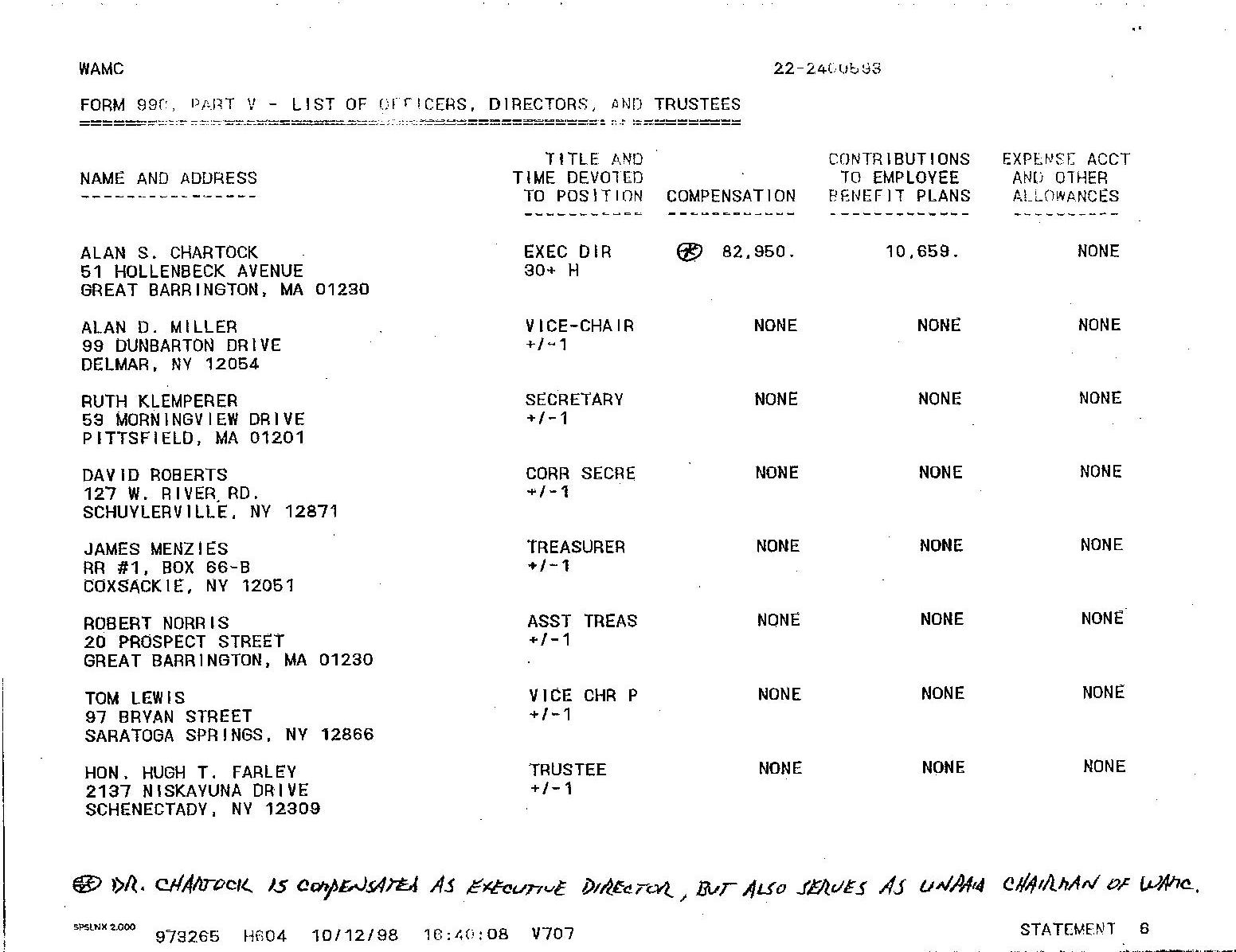

Note especially: The amount WAMC reports to IRS that CEO Alan Chartock received under 'Expense Account'.

Also, please see below:

2005

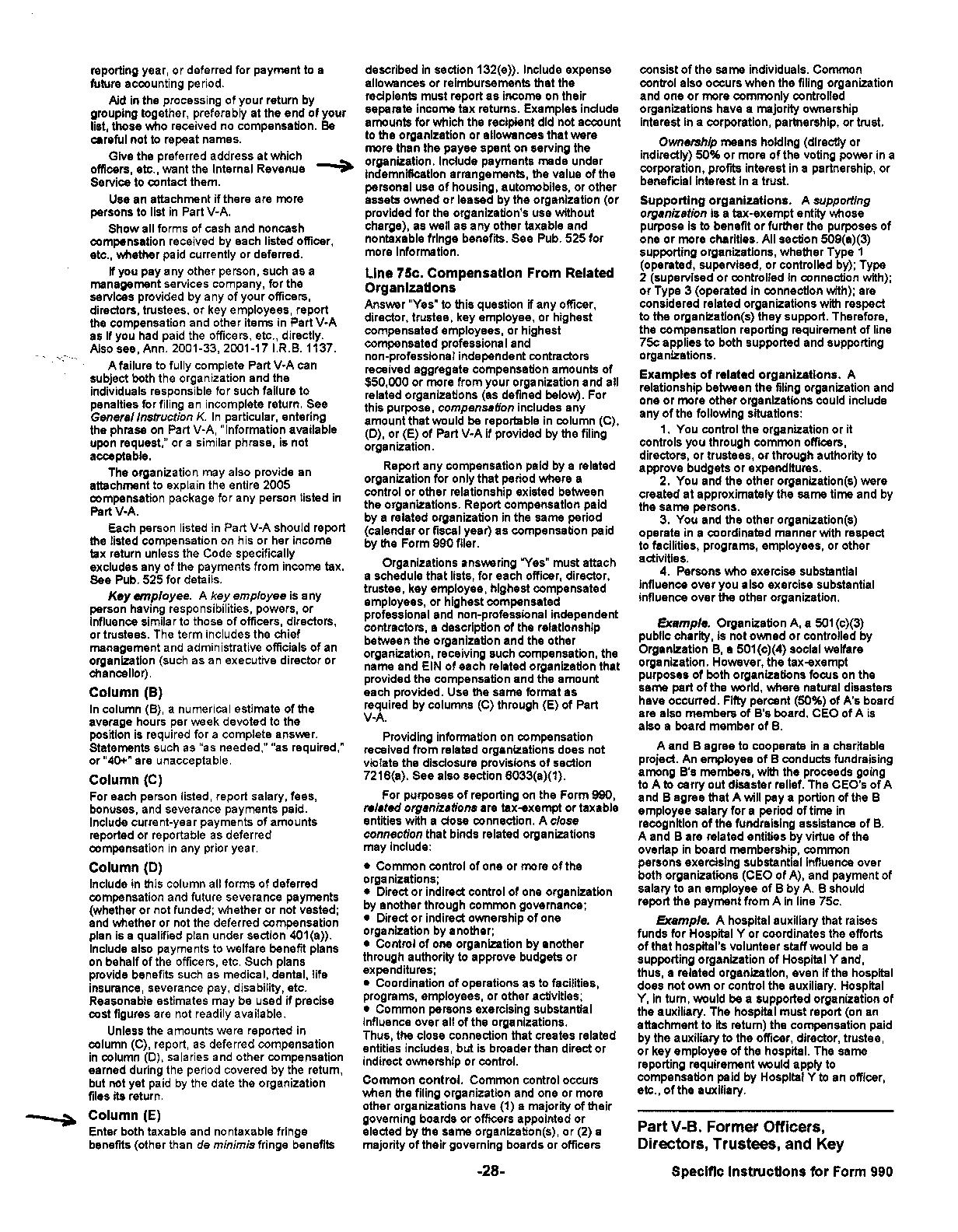

Instructions for IRS Form 990 (pgs. 27-28), explaining what to include

in filling-out Form 990 - Part V.

Please note arrows highlighting

the specific instructions for filling out 'Column E' - 'Expense Account

and Other Allowances'.

Please note especially the following instructions (excerpts):

"Enter both taxable and non-taxable fringe benefits (other than de minimis fringe benefits described in section 132(e))."'Include payments made under indemnification arrangements, the value of the personal use of housing,automobiles,

or other assets owned or leased by the organization (or provided for the organization's use without charge), as well as

any other taxable and nontaxable fringe benefits.' (Italics added.)

Above: Fiscal 1998

2005

Instructions for IRS Form 990 , pg. 28

Above:

2005

Instructions for IRS Form 990, pg. 28.

©2006 WAMC Northeast Pirate Network®/™